In times of economic downturn, the most pressing mandate for executives is to devise strategies that protect their business’ cash flow. The COVID-19 pandemic is no different. Organizations are facing constraints on cash, and millions of people are newly unemployed as organizations respond to the economic pressure with layoffs and furloughs of employees.

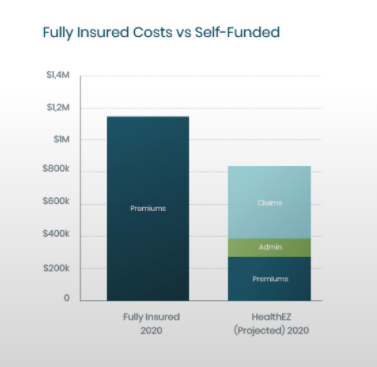

One strategy that organizations should consider as they evaluate how to manage their cash flow is moving from a fully-funded to a partially self-funded health plan. In a self-funded health plan, employers assume part of the financial risk for providing health care benefits to employees and purchase stop loss insurance to protect against catastrophic losses. They pay employee medical costs as they incur them — instead of paying a fixed premium to an insurance company. The only fixed costs employers pay are for administrative expenses and stop-loss insurance premiums. Profits (cash) stay on the books of the employer — not with the insurance carrier.

LARGE INSURERS ARE ACCUMULATING CASH

The COVID-19 pandemic impacts virtually every business that operates today, including large health insurers. While many insurers are agreeing to cover all testing, and in some cases, treatment for COVID-19, insurers will likely experience an increased profit margin this year. They’ll earn this profit because they’ll continue to receive premium payments, but they’ll be responsible for paying far fewer claims.

And yet, despite the profit, insurers are projecting double-digit premium increases in 2021.

For the foreseeable future, very few people will go to the doctor for mild illness. Hospitals have postponed most elective surgeries indefinitely. Not having to pay for these elective surgeries, which typically make up a significant portion of an insurer’s paid claims, will be a significant money saver for health insurance companies.

If you have a self-funded health plan, these are claims you will never pay, so you retain the cash. At HealthEZ, we have seen claims reduce by 38% just since March.

HOW SELF-FUNDED PLANS HELP WITH CASH FLOW

As organizations determine how to survive this economic downturn, they should evaluate how a self-funded plan could help them not only offer competitive employee benefits but also help them manage cash flow. Self-funding helps employers with cash flow because:

- When fewer claims are being paid, the money that isn’t spent stays on the employer’s books — not the health insurer’s. Stop loss premiums and other administrative expenses paid by employers represent about 30% of health plan costs. Claims represent the other 70%.

- Employers build up a cash reserve they can eventually reinvest back into the organization.

- Employers get a one-time cash bump when they switch from a fully-insured to a self-insured plan because there’s a lag in billing for employee claims. This is an immediate, one-time benefit that employers get regardless of when they switch to a self-insured plan. However, with the current pandemic, this cash flow will increase exponentially.

The sample graph below shows an employer’s first 12 months of cash savings under a partially self-funded health plan. In this scenario, it’s projected that the employer will have $101,000 in positive cash flow in the first two months compared to their fully insured plan. Considering the current environment and changes with medical claims, the amount increases to $150,000 in positive cash flow in the first two months.

If you’d like to learn more about the cash benefits of self-funded health plans and what they might mean to your organization, please contact our team. We can discuss what a transition would look like for your organization and review additional incentives currently available from HealthEZ’s stop-loss partners.